Don’t let too many health insurance plan options overwhelm you when shopping through BeWell. We understand it can be stressful to choose a plan, especially if you are selecting one for your household. The good news is all health plans offered through BeWell include free preventative care and cover essential health care services.

When you shop you can choose from a variety of health insurance plans offered from one of four health insurance carriers – plans are categorized in three metal-levels: bronze, silver, and gold.

The metal level does not reflect the quality of care you will receive. Instead, the levels are based on premiums, out-of-pocket costs, and your share of the costs for your health care expenses. Carriers can offer different plans, both privately and through BeWell. If the plans are the same, the rates must be the same on or off BeWell. However, you can only access Advance Premium Tax Credits (APTC), Cost-Sharing Reductions (CSR) or other New Mexico savings you enroll in a health insurance plan through BeWell.

The best level for you depends on your budget and how much health care you expect to need in the coming year. Let’s get into each metal level.

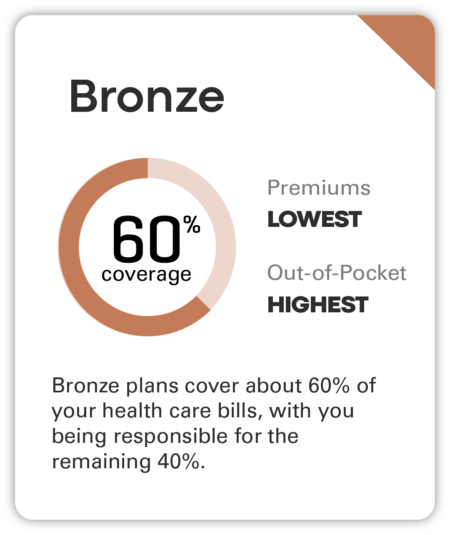

Bronze Health Insurance Plans: Budget-friendly with Some Trade Offs

Bronze plans will save you the most on your monthly health insurance bill if you don’t see the doctor beyond annual check-ups and preventative care. However, the trade-off is they include high out-of-pocket costs. You will pay more each time you visit the doctor and/or pick up medications.

Bronze plans also have high deductibles, which means you may be responsible for thousands of dollars in medical bills before your carrier starts to pick up the tab.

Bronze plans are ideal for customers who want low-premiums and comprehensive coverage to protect from worst-case medical situation and are okay with paying more for health care services and medications.

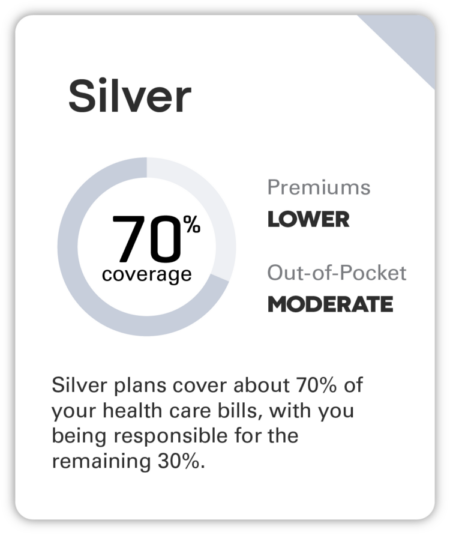

Silver Health Insurance Plans: Finding Balance and Unlocking Savings

Silver plans are a balanced choice, they have slightly higher premiums than bronze and offer lower out-of-pocket costs when you seek care. They are ideal for those who are okay with paying more each month in exchange for lower bills when they go for routine care.

Silver plans are also a go-to choice for anyone who qualifies for financial assistance. Based on your income, you may qualify for extra savings to lower out-of-pocket costs; making routine care and medications even more affordable. Some individuals may also qualify for a $0 monthly premium after receiving Advance Premium Tax Credits.

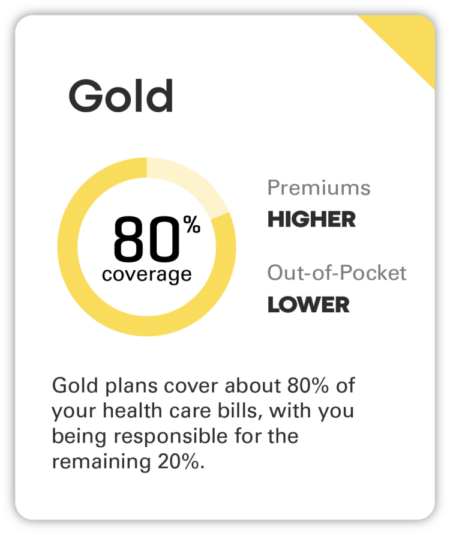

Gold Health Insurance Plans:

Gold plans come with higher monthly premiums but offer the advantage of lower costs for health care services. Think of it as an investment – paying more each month for a lower deductible and better coverage when you need it, like a premium membership.

Ideal for those who often require medical services and prescription refills and are willing to pay higher monthly fees to offset expenses for doctor visits and medications.

Extra Savings and Easy Choices Ahead:

BeWell also includes Turquoise Plans and Clear Cost Plans. For those eligible, these plans offer extra savings based on income levels and offer a standardized approach to health insurance simplifying the decision-making process.

Turquoise Plans: Extra Savings for Specific Incomes

Turquoise plans give extra savings for those with incomes between 100-400% of the Federal Poverty Level (FPL). They provide savings on out-of-pocket costs such as deductibles, copays, and coinsurance.

Turquoise plans are available in both Silver and Gold levels. However, to take advantage of APTC you must choose a Silver plan to get the extra savings.

Clear Cost Plans: Health Insurance in Black and White

Clear Cost Plans are standardized for health insurance. All four carriers offer plans with the same benefits, copayments, deductibles, and out-of-pocket maximum costs within each metal level, making comparisons straightforward and easy.

Quick Tip: You can compare plans from each level to make it easier to narrow down your options and review the costs and benefits of each plan.

Questions? Call 833-862-3935 to chat with us, or schedule a free appointment with a certified assister.