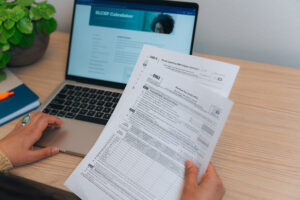

You may need the information on Form 1095-A to complete Form 8962: Premium Tax Credit, for your federal tax return.

If you enrolled in health insurance through BeWell and chose to receive a tax credit in advance to help pay your monthly premiums, the Internal Revenue Service will use your Form 8962, along with other information in your tax filing (such as information about your income and family size), to make sure you received the right amount of tax credit.

If you received too little tax credit over the course of the year, you may get money back when you file your taxes. If you received too much tax credit, you may need to pay back the difference, either in the form of a reduced refund or an amount due when you file your taxes. When you complete Form 8962, you will learn if you need to pay back some of the tax credit you received or if you will receive more money when you get your refund.

If you enrolled in health coverage through BeWell without a tax credit (meaning you paid the full monthly premium), you may use Form 8962 to determine if you are eligible for a tax credit when you file your taxes.